How truckers benefit from quick access to 2290 Schedule 1 through online systems

How truckers benefit from quick access to 2290 Schedule 1 through online systems

Blog Article

I have discovered that many people with the talent and drive to start their own business seldom have the education and tools required to satisfy the bookkeeping requirements for their venture. Therefore, I have compiled this article to help those who may be confused on some of the issues.

Let's take a person under age 65 who makes $80,000 for a salary and apply the two federal income tax systems on his salary to see how much 2290 tax form he generates for the fed.

Among these Form 2290 online choices filing through a company makes the most sense. This option allows you to transfer work to the firm you hire. Of course, reasonable fees will apply, but you get the most out of your money since they will complete the legwork while you just wait for results.

If you are really an expert in your niche, then article marketing is the best method to make money online for free. Just write a refreshing article with unique content and submit to quality article directories. Do not just promote your affiliate products in the articles with excessive promotional words such as blah-blah-blah. Have you ever observed the articles are placed on top of search engines for many of the keywords? This is because of their original content maintained on authentic directories.

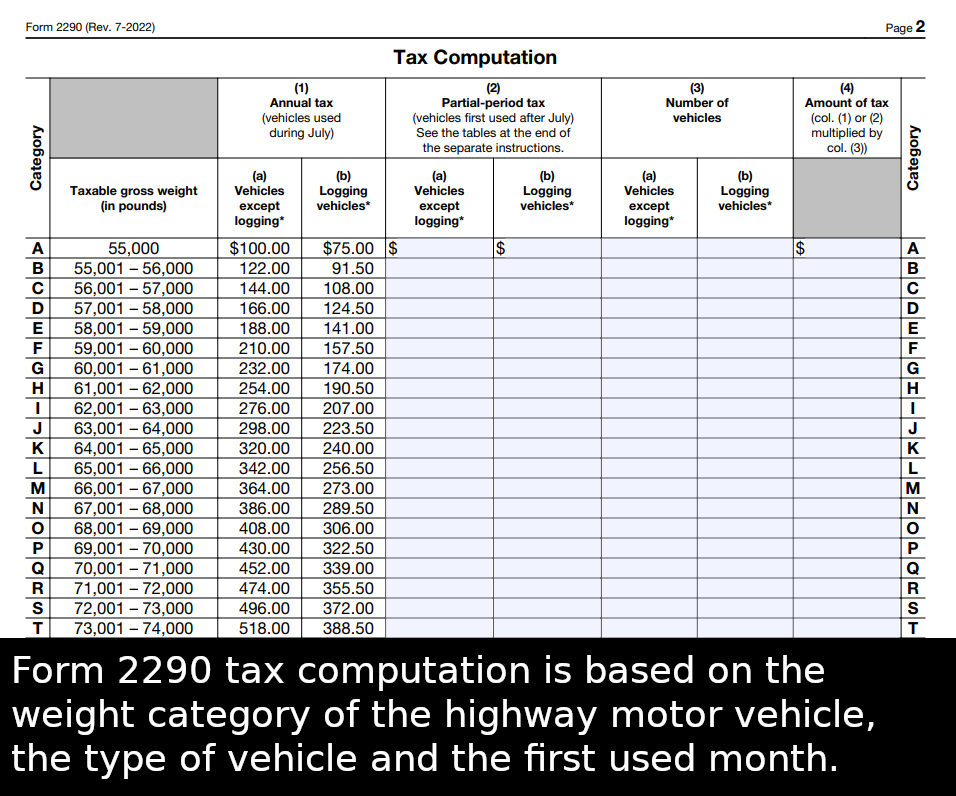

These figures seem to support the argument that countries with high tax rates take care of their residents. Israel, however, has a IRS heavy vehicle tax rate that peaks at 47%, very nearly equal to that of Belgium and Austria, yet few would contend that it is in the same class with regard to civil delivery.

Before operating the crane, operators should carefully read and understand the operation manual from the crane manufacturer. Further, they must always note any instructions given by a reliable instructor or operator. It is also crucial for the crane operator to understand the consequences of careless operation of cranes. They must be instructed of the proper use, prohibition and the safety rules and regulation during the operation.

The IRS has years of experience and teams of people working to ensure that the taxpayer is compliant and understands their legal obligation. That being the case you need to ask yourself this question: Is it worth the risk to save a couple of thousand dollars when I go into the lions den? I assure you it Heavy highway use tax is not. Whether you agree with the notion of charging someone for representation before the IRS, and whether you can afford it, is not the real question. The real question is can you afford not to?